The Ultimate Guide to Choosing a CRM for Insurance

The insurance industry is a complex landscape demanding peak efficiency and exceptional client service. Juggling diverse policy types, managing claims efficiently, and maintaining seamless client communication can feel overwhelming, even for the most organized agencies. A thoughtfully chosen Customer Relationship Management (CRM) system, however, offers the potential to unlock smoother operations, significantly improve productivity, and fuel substantial business growth. This comprehensive guide will empower you with the knowledge and strategic insights necessary to select the ideal CRM for your insurance business, transitioning your agency from reactive problem-solving to proactive, strategic growth. We will delve into key features, crucial considerations, potential pitfalls to avoid, and best practices to ensure you make a well-informed, impactful decision.

Key Takeaways

- Implementing the right CRM for insurance can dramatically increase operational efficiency, potentially by up to 40%, freeing up valuable time and resources for strategic initiatives such as market expansion, new product development, and enhanced employee training. This increased efficiency translates directly into improved profitability and a stronger competitive edge.

- A robust CRM system demonstrably improves client retention rates. By fostering personalized interactions, proactive service, and timely communication, a CRM builds stronger client relationships, leading to increased loyalty and repeat business. This translates into a significant reduction in customer acquisition costs and a more predictable revenue stream.

- Careful consideration of your specific needs and budget is paramount before choosing a CRM. Avoid the common mistake of overspending on features you won't utilize. A tailored approach, focusing on functionality that directly addresses your business challenges, ensures optimal value for your investment. A phased implementation approach can also help manage costs and mitigate risks.

Choosing the Right CRM Features: Functionality and Integration

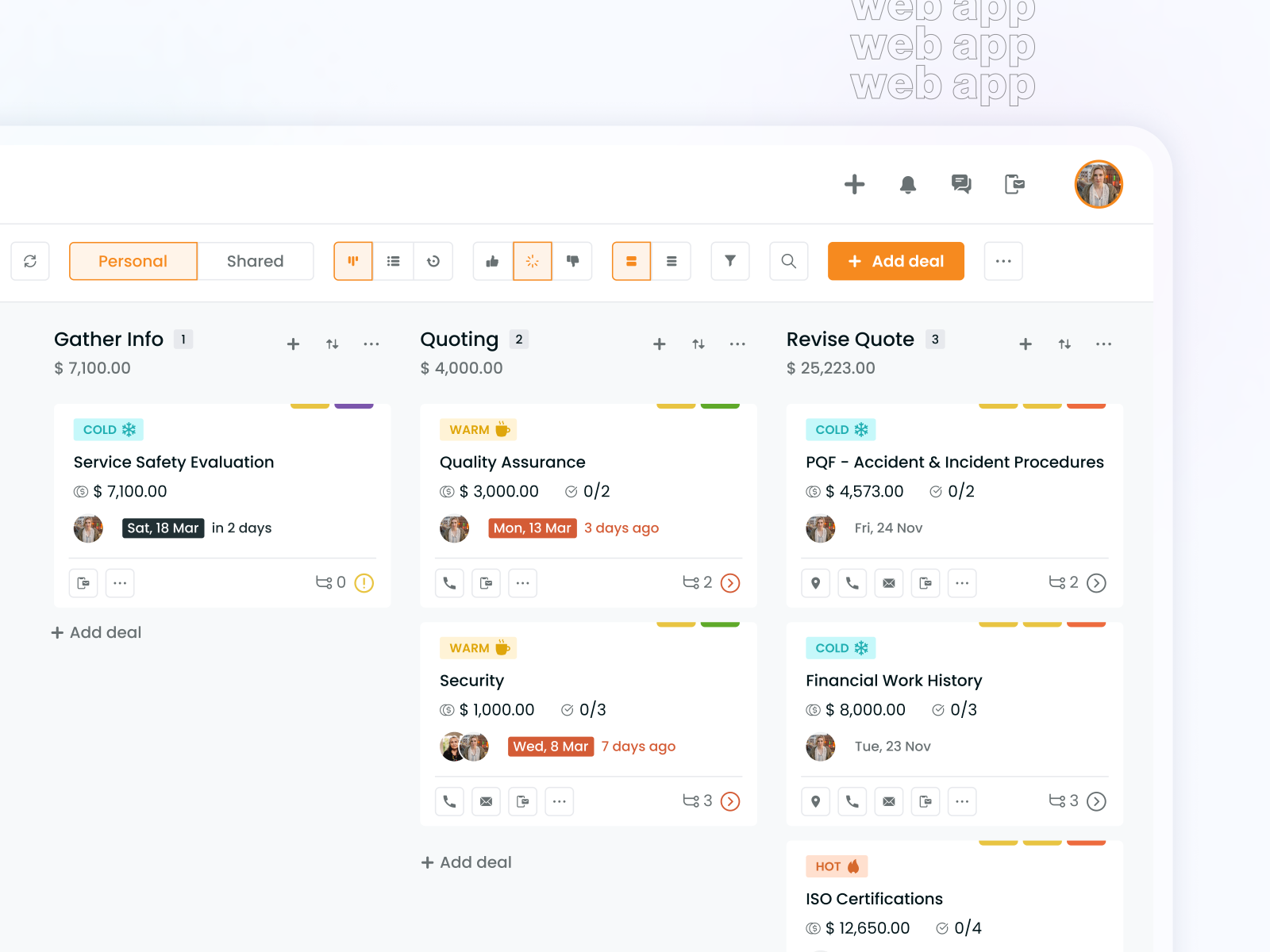

Selecting a CRM for your insurance agency demands a meticulous assessment of its core features. The market offers a diverse range of CRMs, each with varying capabilities and price points. Choosing a system mismatched to your specific requirements can lead to wasted resources, reduced productivity, and ultimately, hinder your agency's growth. One crucial element is the level of customization. Does the CRM offer flexible configurations allowing you to adapt the system to your unique workflows and processes, or will your agency be forced to compromise its existing operational structure to fit the CRM's limitations? Rigidity can stifle efficiency and ultimately negate the benefits of adopting a new system.

Integration capabilities are equally critical, perhaps even more so. Your CRM should seamlessly integrate with other essential business tools. This includes your accounting software (for accurate financial tracking and reporting), your email marketing platform (for targeted client communication), your policy management system (for seamless policy updates and tracking), and potentially other specialized insurance software applications. Think of these integrations as the precisely engineered components of a well-oiled machine. Each part works in perfect harmony to achieve peak operational efficiency. Disparate systems, operating in silos, create inefficiencies and increase the risk of human error.

The most effective CRMs for insurance offer comprehensive reporting and analytics dashboards. These provide crucial insights into sales trends, customer behavior patterns, and the overall performance of your agency. Data visualization tools within the CRM enable quick identification of areas for improvement and allow for data-driven decision-making. This proactive, data-informed approach fosters continuous optimization and contributes to sustainable growth. Advanced features like predictive analytics can even forecast future trends, allowing for preventative actions and strategic planning.

"The right CRM is more than just software; it’s a strategic investment that significantly enhances efficiency, boosts client satisfaction, and ultimately drives substantial increases in profitability and sustainable growth."

Finding the Best CRM for Insurance: A Step-by-Step Guide

Selecting the ideal CRM for your insurance business is not a process to be undertaken lightly. It requires a systematic approach to ensure a successful implementation that delivers real value. Avoid the common trap of choosing a system based solely on price or marketing hype. A structured evaluation process will ensure you secure the right fit for your unique needs.

First, conduct a thorough analysis of your existing processes. Identify the specific pain points hindering efficiency and growth. Where are you losing time and valuable resources? Common areas for improvement in insurance often include client communication (prompt responses, personalized service), policy management (accurate record-keeping, streamlined renewals), and claims processing (faster resolution times, reduced administrative burden). Document these bottlenecks; they will serve as critical guideposts throughout the selection process.

Next, establish a clear budget. CRMs range from basic, affordable options suitable for small agencies to sophisticated, enterprise-level systems designed for larger firms with complex needs. Defining your financial constraints early will help you focus your search and avoid wasting time exploring options beyond your reach.

Then, develop a comprehensive list of essential features. Prioritize the functionalities that directly address your identified pain points and support your overall business objectives. Consider scalability; the chosen CRM should adapt to your agency's growth. Consider the features important for client-facing staff (ease of use, intuitive interface) versus those critical for administrative staff (reporting, data management).

Finally, request and thoroughly evaluate demos from several vendors. This hands-on experience is invaluable. It allows you to assess each system's usability, the intuitiveness of the interface for your staff, the comprehensiveness of the features, and its overall suitability for your agency's unique workflows and requirements. Consider involving multiple stakeholders in the demo process to gather diverse perspectives.

💡 Pro Tip: Negotiation is key. Many CRM providers are willing to offer discounts or customized packages to secure new clients. Be prepared to discuss your specific needs and budget to maximize your leverage during negotiations. Don’t be afraid to walk away if the terms aren’t favorable; the right CRM provider will understand and accommodate your requirements.

Frequently Asked Questions (FAQ)

What are the key benefits of using a CRM for insurance?

A CRM for insurance offers a multitude of benefits that directly impact an agency's bottom line and long-term sustainability. These benefits extend far beyond simple contact management:

- Improved Client Communication: Centralized communication channels ensure prompt responses and personalized service, fostering stronger client relationships and increased loyalty.

- Streamlined Workflows: Automation of repetitive tasks frees up valuable staff time for higher-value activities.

- Increased Sales Efficiency: Improved lead management and sales tracking capabilities accelerate the sales cycle and boost conversion rates.

- Better Policy Management: Enhanced record-keeping ensures compliance and reduces the risk of errors. Streamlined renewal processes enhance client retention.

- Enhanced Data Security: Robust security measures protect sensitive client data, mitigating the risks associated with data breaches.

- Valuable Reporting Capabilities: Comprehensive reporting tools provide insightful data on key performance indicators, enabling data-driven decision-making and continuous improvement. This ensures strategic adjustments are made based on concrete data, not guesswork.

- 360-degree Customer View: Access to a complete customer profile allows for proactive service, personalized communication, and improved understanding of customer needs. This enhances customer satisfaction and builds lasting relationships.

Conclusion

Choosing the right CRM for your insurance agency is a pivotal decision with profound implications for your business's short-term efficiency and long-term success. By meticulously analyzing your agency's specific requirements, conducting thorough research, and following a structured selection process, you can confidently select a CRM that transforms your operations. The right system will empower you to streamline operations, boost efficiency, elevate client service, and ultimately, drive significant and sustainable growth. Don't underestimate the potential of a well-integrated CRM to revolutionize your insurance business. The right system is a strategic investment that will pay dividends for years to come, providing a competitive edge and ensuring your agency's continued success in a dynamic market. Remember, the perfect CRM is the one that precisely aligns with your agency's unique needs and long-term vision.

0 Response to "The Ultimate Guide to Choosing a CRM for Insurance"

Post a Comment